hedge funds

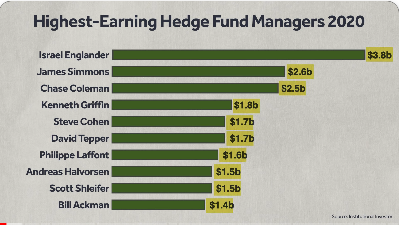

Here’s a chart showing how much the 10 highest-earning hedge fund managers made in 2020. Yeah, those figures are not millions but billions. To put it into perspective, Tim Cook, the CEO of Apple, arguably the most valuable company in the world, made $15 million in 2020, which is a tremendous amount of money. But when you compare it to someone like Israel Englander, well, it just looks minuscule. Honestly, you can hardly even see it.

In this article , I want to explain what a hedge fund is and why on earth they make so much money. In short, a hedge fund is essentially a structure that lets you invest your own money as well as other people’s money into any kind of investment that you want without really too much regulation.

Key Points to Cover

So let’s get into the details. There’s really five main parts that I want to cover:

- Clients

- Fee Structure

- Investing Strategies

- Risk Levels

- Performance Measurement

Clients

So who are the clients? There’s really two main sides to this. On the one hand, we have the general partner, which is basically a person that actually manages the money and typically tends to put a portion of his own money in there as well. Then on the other side, we have the limited partners, which are all the different clients that bring in the majority of the money for the fund. Typically, limited partners might include pension funds, sovereign funds, endowments, as well as some high-net-worth individuals.

And just to be clear, these funds don’t actually accept money from normal people like you and me. They have a sort of minimum requirement, so essentially a minimum amount of money that you need to put in. It’s typically well above the million-dollar mark. In addition to that, they have a lock-up period, which essentially means that you can’t take the money out for a set period—usually something like five years. So even if you need that money, they don’t let you take it out. That’s why it’s mainly only open to sophisticated investors.

Fee Structure

Let’s look at their fee structures. There are typically two types of fees in a hedge fund.

The first one has to do with management fees, which are typically a fixed percentage on a yearly basis—say around the 2% mark. So that’s 2% of the assets under management, which is basically the amount of money that the fund manages.

The second type of fee has to do with performance fees, which are typically a percentage of the profits. These are not guaranteed and they’re not fixed. Essentially, if the fund does well and has a positive return, they’ll typically take 20% of that.

Let’s look at an example. Suppose this hedge fund manager manages a $100 million fund. Every year, he gets a management fee of 2%, so that’s basically $2 million to pay for salaries, etc. Now the beauty of this for him is that regardless of whether he wins or loses money, he gets a guaranteed $2 million. So essentially, he guarantees that he’ll be able to pay everyone, and all of that stress is gone.

As for the performance fee, let’s say he’s up $30 million this year. Typically, the performance fee is around 20%, so essentially he gets $6 million for that. That’s basically the structure. But now imagine the fund is actually a $100 billion fund. Hedge funds of this size actually do exist, by the way. Now, this management fee is not $2 million, but rather $20 billion. And if his fund was up 30%, that’s $30 billion, and for him, that would be $6 billion in performance fees. So you can really start to see how they get so rich and how they enter the Forbes list, for instance.

But that said, it’s obviously not easy to raise funds of this size, let alone actually perform with them. So a common term they use in finance is called “the two plus 20,” and by that, they essentially mean this: 2% management fees and 20% of profits.

Investing Strategies

Let’s look into their investment strategies. Because there are so many types of hedge funds, we’ll just focus on three of the most popular strategies, and those are:

- Global Macro

- Quantitative (Quant)

- Event-Driven

Global Macro Strategy

A global macro strategy bases its investment decisions on global economic and political trends instead of focusing on individual companies. That basically means that they take a top-down approach. They base their decisions on things like interest rates, economic models, currencies, or politics. Their investment cycles are typically medium to long term, where they might stay in something for even a couple of years. Among the most famous global macro hedge funds are Bridgewater, which is the largest hedge fund in the world, as well as Moore Capital.

Quantitative Hedge Funds

As for quantitative hedge funds, essentially a quant hedge fund doesn’t rely on humans for their trades; instead, they rely on algorithms that base their investment decisions. Essentially, they employ a big army of physicists, mathematicians, and computer scientists to create an algorithm that will predict the investment opportunities and basically execute them automatically. Their focus is mainly short-term—sometimes even less than a second to enter and exit a trade. That’s why they use computers for that. Nowadays, quant hedge funds are probably the most popular, especially given their really good returns compared to some other hedge funds. Among the most famous ones are Two Sigma and D. E. Shaw. D. E. Shaw was actually founded by a computer science professor at Columbia University, so it kind of explains the type of people that work there.

Event-Driven Hedge Funds

Lastly, we have event-driven hedge funds, which basically target mispricings because of major events like an acquisition, an earnings call, or a bankruptcy, say. Their research mainly involves really getting into the financial statements of companies, reading all their public documents, and trying to get as much information as possible. An example of their strategy could be a healthcare company waiting to see if a new game-changing drug that they invented is going to get approved by the regulators. Depending on that, that’s going to have a big impact on that company, and so the hedge fund would take a positive or negative position depending on that and try to predict it. These are typically short- and medium-term investments. Among the most famous hedge funds are Davidson Kempner and DuPont Capital.

These investment strategies I mentioned are typically quite generic, and sometimes they’re a lot more narrow and specific, like focusing on one particular country. Other times, they might use hybrid models where it’s a bit of quant and a bit of global macro, and they try to merge that together.

Risk and Regulation

Let’s now look at risk and regulation. With a normal fund like, say, a pension fund where you or I might put money in, they’re actually very regulated. Essentially, they’re not allowed to use certain financial instruments. For example, they’re not allowed to incur debt. Sometimes they’re limited to specific countries and various other things like that. Essentially, as a normal consumer, you don’t want them to lose your money, so basically, they’re very risk-averse in that sense, and they’re highly regulated as such.

As for a hedge fund, the risk levels are actually very different. It’s a completely different story, mainly because they only deal with sophisticated investors and they’re not regulated at all. So they basically can do anything they want as long as they make money. That’s really all that matters to them.

And to illustrate just how far they’re willing to go to make money, check this article out. It was written by Business Insider back in 2012 and says that a hedge fund has physically taken control of a ship belonging to Argentina’s navy. Now, if you look into the details, it’s because Argentina hasn’t paid back a 2001 bond that they owe to them. That’s actually 11 years ago we’re talking about—since 2001. So yeah, they rocked up to Ghana and seized the military ship. Say for a pension fund, well, they probably won’t be allowed to go all the way to Ghana to take a ship, and secondly, they probably won’t know what to do with it. I don’t know what these guys did with it, but it’s just to illustrate the extent to which they’re willing to go, and they can go because of the lack of regulation.

Performance

Lastly, there’s performance. I’d say there are two main metrics for this: returns and diversification.

Returns

For returns, we typically measure them against a benchmark. For instance, it might be measured against the S&P 500. So anything above that is positive, anything below is negative. It’s that simple, really.

Diversification

Another big performance metric is diversification. Basically, because what they do is so different from your average investor, that means they’re not correlated to the market. So even though the market might be in a recession, the hedge funds might actually be doing well and making money. And that’s something that’s very attractive to investors. Obviously, the opposite also applies. When the market’s doing well, maybe they’re not doing so well, and that’s not good. But overall, investors like that, mainly for diversification.

Conclusion

So yeah, that’s the summary of hedge funds. Thank you for reading. I hope you found it useful. I’ll leave two books in the description if you’re interested in some further reading on the topic, and I’ll catch you in the next one.